Effect of applying the CAMEL model to profitability of banks )An applied study on a number of Iraqi banks for the period 2010-2016(

DOI:

https://doi.org/10.33095/jeas.v26i117.1823Keywords:

نموذج التقييم المصرفي (CAMELS)، الربحية, الجهاز المصرفي العراقي, المصارف الخاصة., (CAMELS), profitability, the Iraqi banking system, private banksAbstract

The evaluation of banks plays an important role in maintaining the interests of customers with the bank as well as providing continuous supervision and control by the Central Bank. The Central Bank of Iraq conducted an assessment of the Iraqi banks through the implementation of the CAMEL model during a certain period. This evaluation did not continue. The research provides continuity to the Central Bank's assessment and as a step to continue the evaluation process for all banks through the use of the CAMEL model. ROA and ROE by using the regression model for four Iraqi banks registered in the Iraqi market for securities during the period 2010-2016. The results showed that the capital and profitability indicators have a significant effect on the profitability variables. The efficiency of management had a Negative impact on profitability variables and banks maintain high liquidity ratios that should be invested.

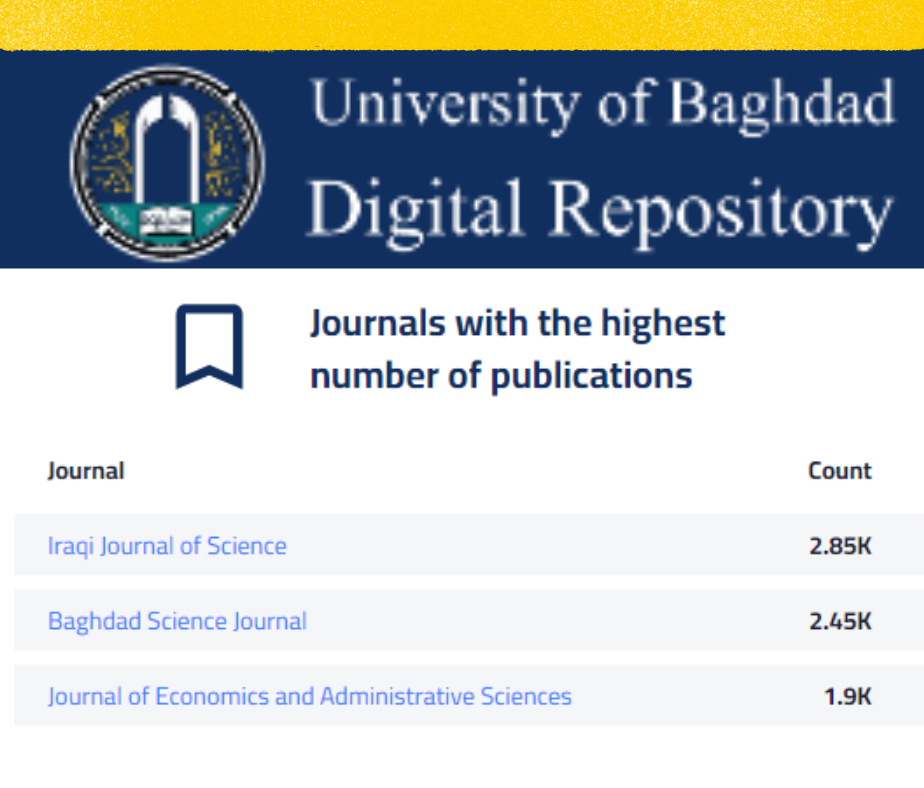

Downloads

Published

Issue

Section

License

Articles submitted to the journal should not have been published before in their current or substantially similar form, or be under consideration for publication with another journal. Please see JEAS originality guidelines for details. Use this in conjunction with the points below about references, before submission i.e. always attribute clearly using either indented text or quote marks as well as making use of the preferred Harvard style of formatting. Authors submitting articles for publication warrant that the work is not an infringement of any existing copyright and will indemnify the publisher against any breach of such warranty. For ease of dissemination and to ensure proper policing of use, papers and contributions become the legal copyright of the publisher unless otherwise agreed.

The editor may make use of Turnitin software for checking the originality of submissions received.

How to use the OJS system

How to use the OJS system