The Role of Joint Audit in Reducing Cases of Financial Default in Banks Listed on the Iraq Stock Exchange

DOI:

https://doi.org/10.33095/sn1k8r80Keywords:

: joint audit, financial distress, default casesAbstract

The method of joint auditing is not a recent appearance, but it is needed at the present time due to the occurrence of many global problems and crises. The research problem was represented by the increasing cases of financial distress of economic units, especially the collapse of economic units that occurred in the recent global crises. The research was based on the hypothesis that applying The method of joint auditing in economic units helps in reducing cases of financial distress, as the research aimed to measure the extent to which joint auditing can reduce the occurrence of cases of financial distress in economic units listed on the Iraq Stock Exchange. The research included 14 private banks listed on the Iraq Stock Exchange. Iraq Securities Exchange as a sample for a period of ten years from 2011 to 2020. The research used the survey method to measure the application of the joint audit method, and used the KIDA model to measure financial distress in the research sample. The most important results of the research were that financially distressed units decreased with the application of the joint audit method, that is, whenever there was a joint audit, the incidence of financial distress in economic units decreased.

Downloads

Published

Issue

Section

License

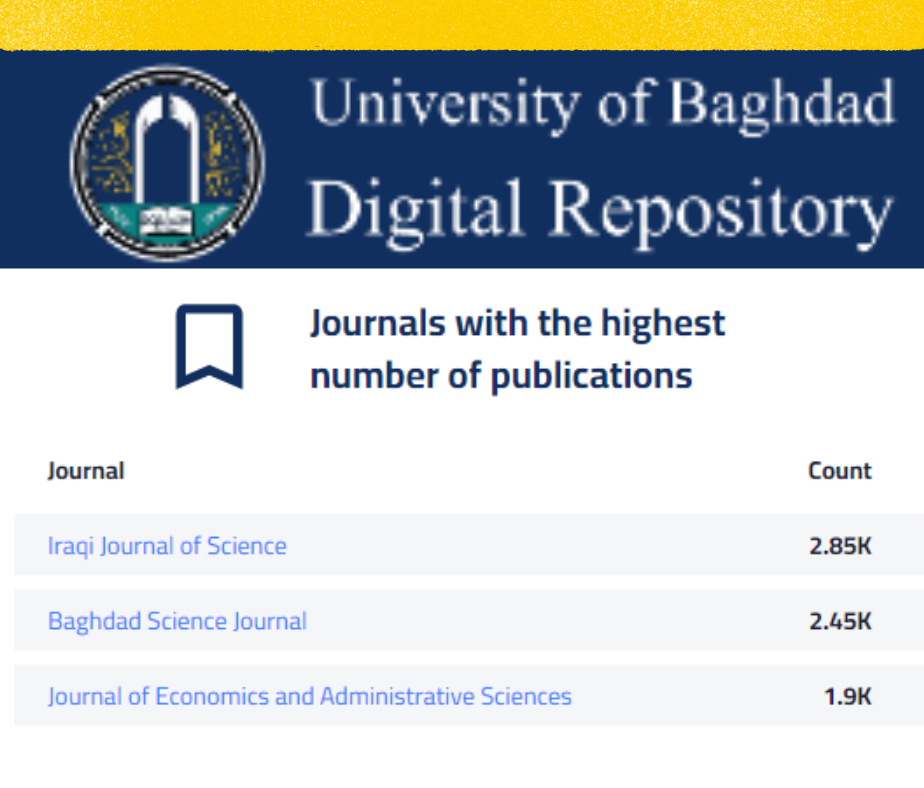

Copyright (c) 2024 Journal of Economics and Administrative Sciences

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Articles submitted to the journal should not have been published before in their current or substantially similar form or be under consideration for publication with another journal. Please see JEAS originality guidelines for details. Use this in conjunction with the points below about references, before submission i.e. always attribute clearly using either indented text or quote marks as well as making use of the preferred Harvard style of formatting. Authors submitting articles for publication warrant that the work is not an infringement of any existing copyright and will indemnify the publisher against any breach of such warranty. For ease of dissemination and to ensure proper policing of use, papers and contributions become the legal copyright of the publisher unless otherwise agreed.

The editor may make use of Turnitin software for checking the originality of submissions received.

How to use the OJS system

How to use the OJS system